In a unanimous decision on April 10, the Port of Ridgefield’s commissioners approved a controversial funding tool to finance industrial developments, which would revive the city’s historic waterfront.

The port will pay for the improvements through tax increment financing (see breakout box), which will be applied for two tax increment areas (TIA) chosen by the Port of Ridgefield.

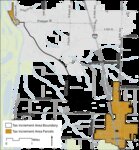

The first zone encompasses Ridgefield’s waterfront and portions of the city’s downtown district. The second area consists of parcels in proximity to the Interstate 5 and Northeast 10th Avenue corridors. Nick Popenuk, a public finance consultant working for the port, said TIAs cannot overlap with others, such as those imposed by the City of Ridgefield.

The port intends to develop the Ridgefield waterfront property into a multi-purpose waterfront through various projects, including road development, lighting installments and improving utilities along its waterfront. Among the planned projects is the construction of a parking lot to alleviate congestion caused by cars accessing the public boat launch. Additionally, the port aims to create dedicated waterway access points for local fire districts and the Clark County Sheriff’s Office. Plans also include the development of a mixed-use building to bring port meetings back to the waterfront and the installation of electric vehicle charging stations at the port’s current facility on Railroad Avenue. Furthermore, TIF funds will contribute to establishing a waterfront park, a joint effort between the port and the City of Ridgefield in the preliminary design stage. The port also intends to use TIF funds to develop commercial or industrial facilities near the I-5 and Northeast 10th Avenue corridors and in Ridgefield’s downtown district.

The port expects to receive over $43 million in revenue from the imposed TIFs over a 25-year period. Clark-Cowlitz Fire Department levy is currently holding a public vote in August to lift their current levy from $1.16 per $1,000 to $1.50 per $1,000 in assessed property value. If the district’s lid lift is successful, and if the current EMS levy is reinstated, the port expects to make over $57 million in a 25 years.

In an April 11 meeting, Port of Ridgefield CEO Randy Mueller told the City Council that not all projects may receive funding within the 25-year period. Per state law, intended projects must be made public for fund use ahead of the imposed TIFs, according to Mueller.

The TIF tool is controversial for several local agencies that receive revenue through property tax collection. In public comments during the April 10 port meeting, Clark-Cowlitz Fire Rescue Commissioner Larry Bartel criticized the 2021-imposed House Bill 1189, which allowed TIFs to be enacted in Washington.

“Fire Districts, hospital districts (and) library districts across the state are just screaming about this bill,” Bartel said. “Right now we face a low of $33 million to a high of $62 million [in revenue] we're gonna lose for 25 years … We are going to continue to work at the state level to make changes.”

Bartel praised the Port of Ridgefield’s commissioners for communicating with the department regarding the future TIFs, despite their disagreements. Bartel and the port commissioners maintained their promise to discuss possible mitigation of TIFs during proceedings.

“We don't think it's a good bill,” Bartel said. “We don't think it serves our taxpayers, but it is the law. I don’t believe it’s right.”

Dean Bloemke, a retired Clark County Fire District 6 commissioner, told the port commissioners that the TIFs would put a great burden on the fire district.

“I don't think you guys would like it if the fire district was putting this on the port,” Bloemke said. “And you say it's not raising taxes. It is gonna raise taxes, only the fire districts are gonna have to do the labor to try and mitigate the funds that they're gonna lose over the span of this project.”

Port of Ridgefield Commissioner Scott Hughes said he understood their disagreement, but advocated for the necessity of the TIFs.

“I think what makes it tough is (that) the stuff that we do is completely unsexy,” Hughes said. “But it’s the stuff that has to come first, before any development grows. In order for the fire department to grow, we have to put in infrastructure [to] allow it to grow. You don't put in a subdivision and then after the fact put in a road to service. You have to do it first, and that money comes first.”

The port will start receiving revenue next year, with annual income projected to increase with increasing property taxes. The Port of Ridgefield is expected to incur debt from its developments within the 25 year period until more revenue is received from TIFs.